As April rolls in, tax season is in full swing. While you’re focused on filing your returns, cybercriminals are working just as hard to steal sensitive financial information. Tax-related scams, phishing attacks, and identity theft are on the rise, making it crucial to safeguard your personal and financial data. Here are some essential cybersecurity tips to keep your information safe this tax season.

1. Use a Secure Internet Connection

Public Wi-Fi networks are convenient but highly insecure. Cybercriminals can intercept data sent over unsecured connections, potentially gaining access to your financial details. Always file your taxes using a secure, private internet connection, preferably at home or through a trusted VPN (Virtual Private Network) for added encryption.

2. Beware of Phishing Emails and Tax Scams

Scammers frequently pose as the IRS or tax preparation services to trick individuals into revealing personal information. Be cautious of:

- Emails claiming urgent action is required on your tax return.

- Requests for your Social Security number (SSN) or banking details via email.

- Links directing you to suspicious-looking websites.

The IRS never initiates contact through email, text, or social media regarding tax payments or refunds. If you receive a suspicious message, report it at irs.gov.

3. Use Strong, Unique Passwords

If you’re filing taxes online, use a strong and unique password for your tax software or IRS account. Consider a passphrase instead of a traditional password, such as a combination of unrelated words and symbols (e.g., “BlueSky$Tax2024!”). Enable multi-factor authentication (MFA) whenever possible for an added layer of security.

4. Keep Your Devices Updated

Outdated software is a prime target for cybercriminals. Ensure your operating system, web browser, and antivirus software are up to date. Tax software providers release security patches to protect against new threats, so be sure to install updates before filing.

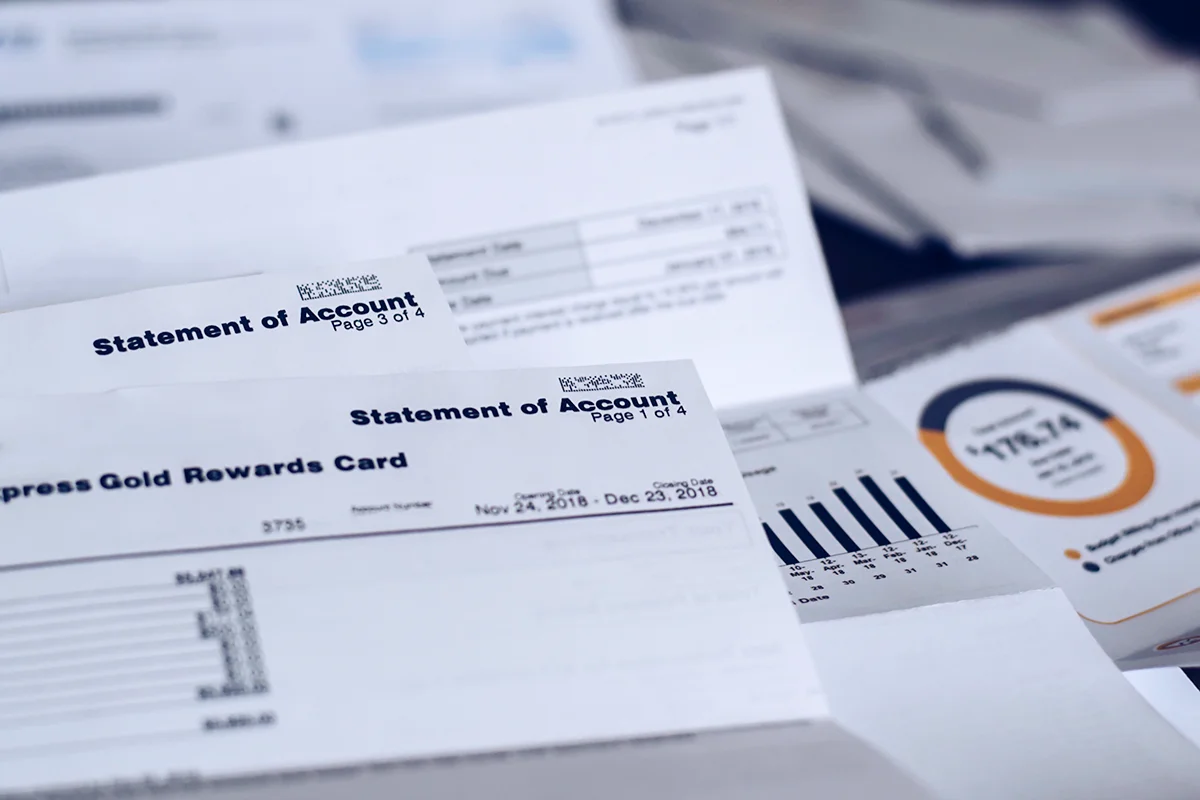

5. Store and Dispose of Documents Securely

After filing your taxes, securely store digital copies of tax returns in an encrypted folder or on an external hard drive. If you have physical documents containing sensitive information, shred them before disposal to prevent identity theft.

6. Only Use Trusted Tax Filing Services

Whether using tax software or hiring a tax professional, choose reputable services with strong security protocols. If filing through a professional, verify their credentials with the IRS Directory of Federal Tax Return Preparers.

7. Monitor Your Financial Accounts

Regularly review your bank statements, credit reports, and IRS account for any suspicious activity. If you suspect tax fraud or unauthorized filings, contact the IRS immediately. Consider placing a fraud alert on your credit file for added protection.

Stay Safe with Computer Headquarters

At Computer Headquarters, we understand the importance of cybersecurity, especially during tax season. If you need help securing your computer, setting up a VPN, or ensuring your devices are protected, our IT specialists are here to assist you. Don’t let cybercriminals turn tax season into a nightmare—stay vigilant, stay secure, and file with confidence.

Need assistance with cybersecurity or data protection? Contact CHQ today!